The UK offshore funds tax reporting regime applies to investment funds located outside of the UK. The regime was introduced in 2009 when it replaced the Distributor Status regime. Offshore funds which comply with the regime can provide their investors with a tax treatment that is broadly similar to that provided by UK authorised funds.

So long as an offshore fund complies with the reporting regime, investors are subject to income tax on income that is generated by the fund and, ultimately, capital gains tax on their remaining profit on disposal. By contrast, investors in non-reporting funds are subject to income tax on any profit on disposal.

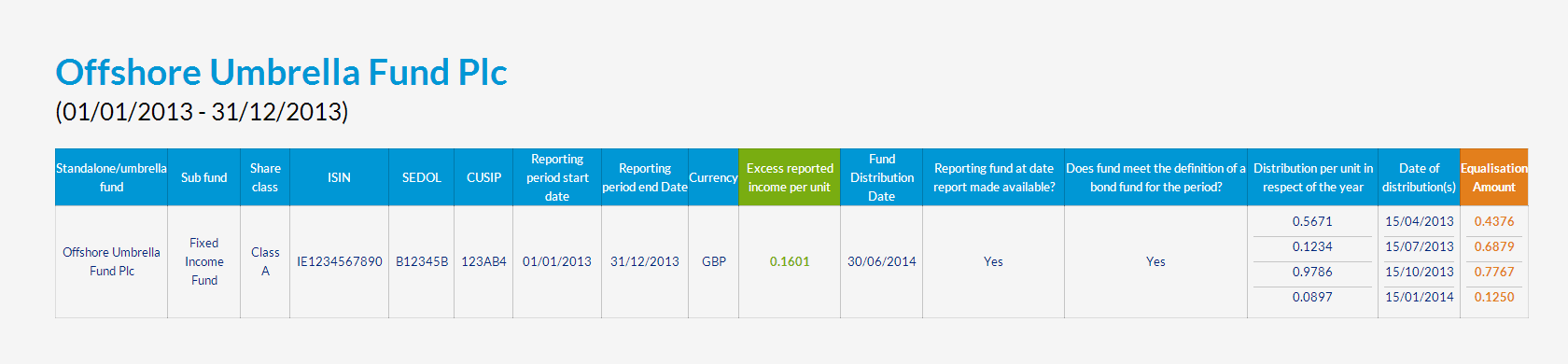

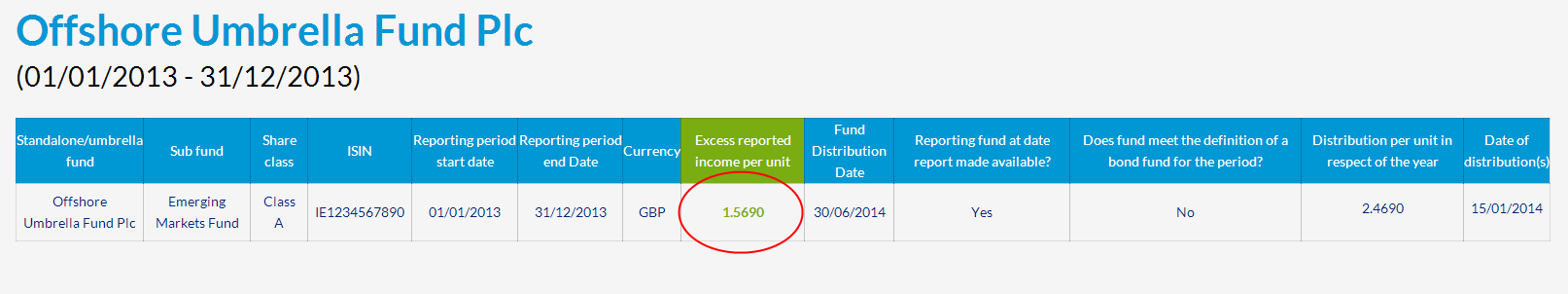

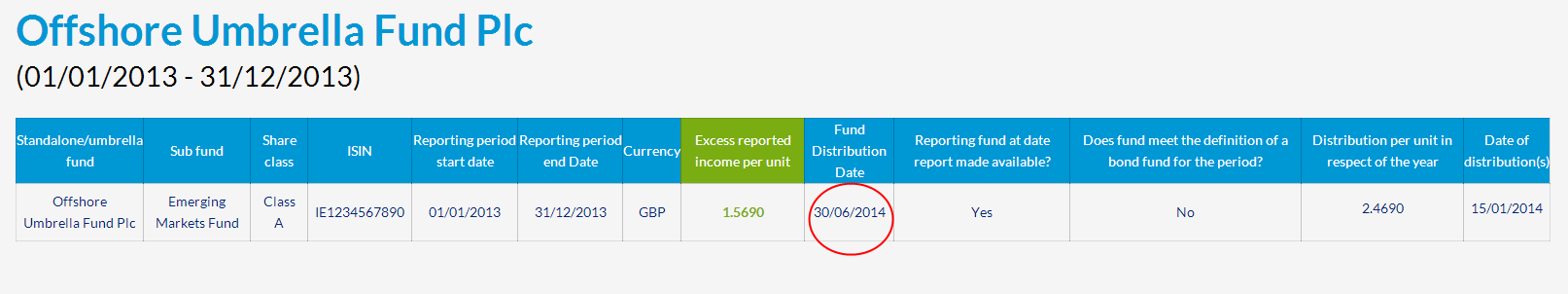

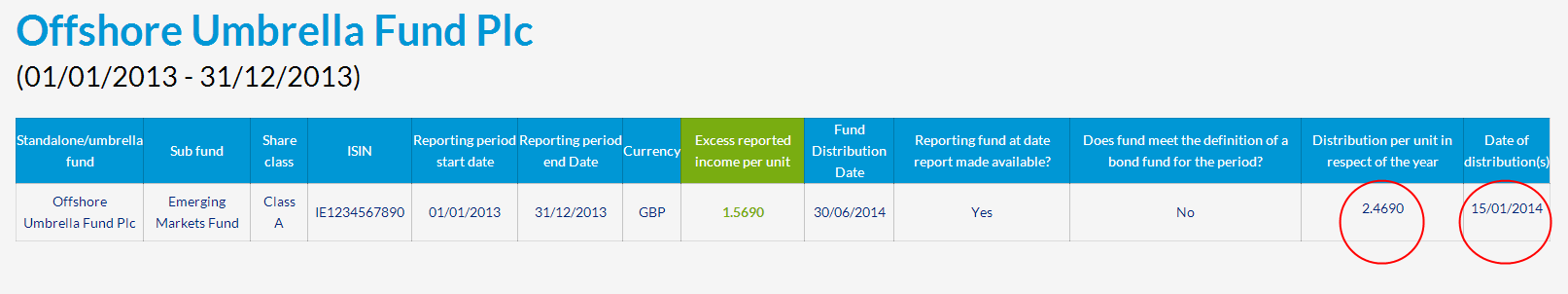

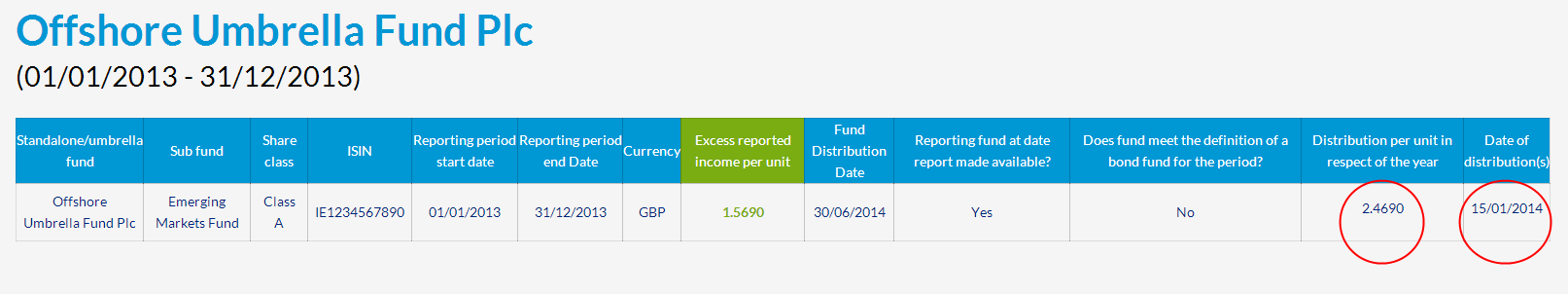

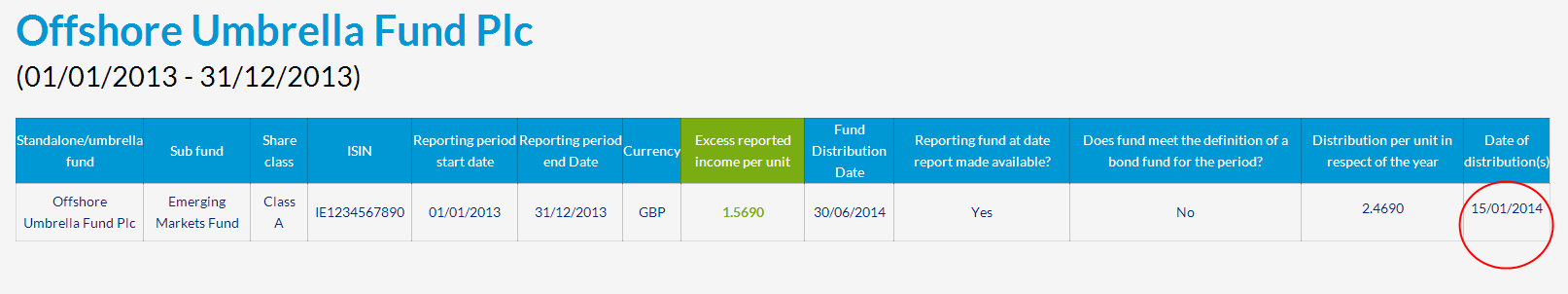

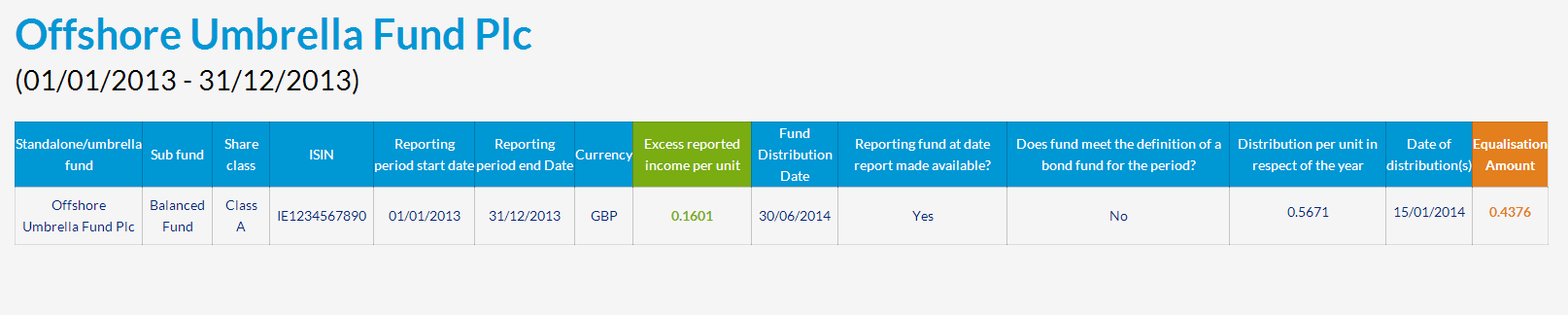

Once registered as a reporting fund, the fund is obliged to provide to investors reports setting out the amount of income per unit/share earned during the most recent reporting period. This is so that UK investors can understand how much income they have earned for the purposes of preparing their own tax returns.